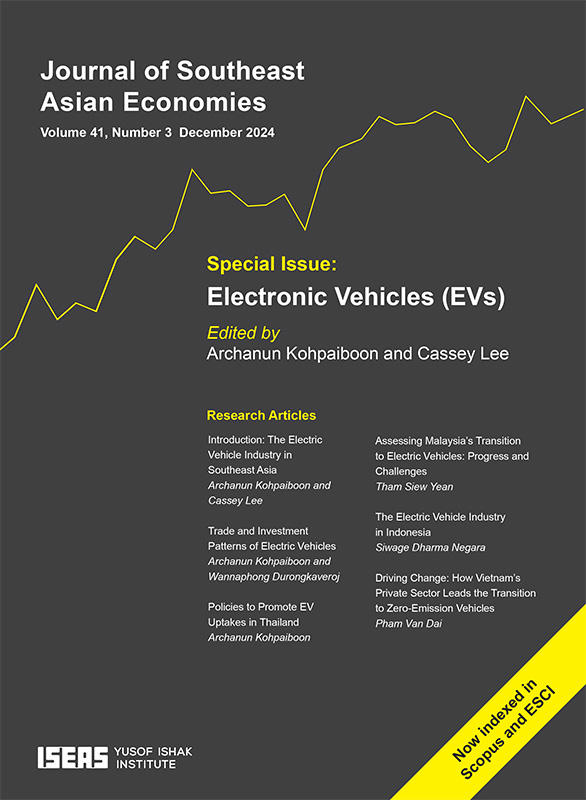

Journal of Southeast Asian Economies Vol. 41/3 (December 2024). Special Issue on "Electric Vehicles (EVs)"

Date of publication:

December 2024

Publisher:

ISEAS – Yusof Ishak Institute

Number of pages:

116

Code:

AE41/3

Soft Cover

ISSN: 23395095

Contents

-

Journal of Southeast Asian Economies Vol. 41/3 (December 2024). Special Issue on "Electric Vehicles (EVs)"

[Whole Publication, ISSN: 13395206] -

Preliminary pages

- ARTICLES

-

1. Introduction: The Electric Vehicle Industry in Southeast Asia, by Archanun Kohpaiboon, Cassey Lee, authors

-

2. Trade and Investment Patterns of Electric Vehicles, by Archanun Kohpaiboon, Wannaphong Durongkaveroj, authors see abstractThis paper examines trade and investment patterns in the electric vehicle (EV) industry. International trade of EVs and their parts is highly concentrated among a handful of countries dominated by China and a few high-income countries. The global value chains in the EV industry are not geographically clustered but are spread internationally. The exception is EV batteries where their factories are often located close to either EV assembling plants or rich sources of critical minerals. It seems too early for EV makers to set up manufacturing affiliates in developing countries due to economic fundamentals such as the nascent stage of production technology, availability of charging stations and uncertainty about EV adoption. Hence, the first-mover advantage in enticing EV manufacturers to establish affiliates does not exist at this stage. Any radical policy actions to develop EV manufacturing hubs at the heavy expense of the existing internal combustion engine vehicles (ICEV) industry could do more harm than good.

-

3. Policies to Promote EV Uptakes in Thailand, by Archanun Kohpaiboon, author see abstractThe paper analyses the government’s responses to the rise of electric vehicles (EVs) in Thailand. Initially, EVs were regarded as one among many environmentally friendly vehicles, with only slightly different incentive packages for these vehicles. From 2017 onwards, a technological leapfrogging agenda has dominated policy, and this reached its peak in 2022 when a direct subsidy in favour of battery electric vehicles (BEVs) was offered in exchange for EV battery localization and local manufacturing of BEVs. As a result, the number of registered BEVs jumped tenfold within three years. This policy was implemented at the expense of existing internal combustion engine vehicle (ICEV) production which is at the current core of Thai automotive manufacturing. In addition, given the inconsistency of trade liberalization on completely built unit (CBU) vehicles, the policy measures greatly favoured Chinese EVs. The government policy will only be justifiable if the positive net long-term gains exceed the short-term fiscal resources spent. The long-term gains will be in terms of forming an EV industry and its supply chain.

-

4. Assessing Malaysia’s Transition to Electric Vehicles: Progress and Challenges, by Tham Siew Yean, author see abstractThe shift towards the adoption of Electric Vehicles (EVs) in Malaysia is motivated by the need to reduce greenhouse gas emissions and ambitions to revitalize manufacturing by attracting new investments to this sector. The paper aims to examine the progress made thus far and the outstanding challenges in the aspired shift towards EVs. The main findings show that besides EV assembly operations, new investments in the emerging EV supply chain include the emergence of manufacturing in synthetic minerals and certain niches in parts of EV battery development as well as the manufacture of EV chips in the semiconductor sector. The government has used industrial policies to stimulate the demand and supply of EVs. Incentives to stimulate demand have noticeably increased the number of EVs in line with the post-COVID-19 economic recovery. While these incentives have stimulated the demand and supply of EVs, they are still far short of the aspired targets for EV adoption. Outstanding challenges that limit EV adoption include fossil fuel subsidies, a lack of affordable EVs and a slow roll-out of charging infrastructure. EV adoption can therefore only escalate if these domestic challenges can be surmounted.

-

5. The Electric Vehicle Industry in Indonesia, by Siwage Dharma Negara, author see abstractThis paper provides an overview of Indonesia’s policy in the automotive sector, highlighting the transition from internal combustion engine (ICE) vehicles to electric vehicles (EVs). It assesses the current performance of the broader auto industry and identifies critical challenges facing EV development. Indonesia aims to establish itself as a leader in the EV industry by leveraging its abundant nickel reserves for battery production. With ambitious targets for electric motorcycles and cars, the government seeks to phase out non-electric vehicles by 2050. However, EV adoption has been slower than anticipated, hindered by various factors, including cost barriers and inadequate supporting infrastructure. Building an EV ecosystem in the country will require clear policies and regulations in terms of incentives, local content requirements, and partnerships between local firms and global manufacturers to enhance technology transfer. The government should also implement stricter emissions standards for traditional vehicles and establish clear guidelines for the transition to EVs, which can create a supportive environment for market adaptation.

-

6. Driving Change: How Vietnam’s Private Sector Leads the Transition to Zero-Emission Vehicles, by Pham Van Dai, author see abstractVietnam has set ambitious targets for adopting Zero-Emission Vehicles (ZEVs) as part of its goal to achieve net-zero emissions by 2050. However, recent growth in the local ZEV market has been primarily driven by private sector initiatives, rather than comprehensive government support. Analysing market development and current policy frameworks, the study identifies key areas where government intervention is essential to bridge the gap between current progress and ambitious targets. It recommends that the government take a more proactive role in implementing demand-side incentives, such as rebates for electric motorcycles to accelerate the electrification of the most common mode of transport. It should also establish robust policies, including a ZEV sales mandate, to help the market reach critical mass. The government should also subsidize and support the development of charging infrastructure by leveraging state-owned enterprises with extensive station networks.